Introduction to Qianhai Settlement (Commercial Factoring)

In May 2015, Qianhai Settlement Co., Ltd. established a wholly-owned subsidiary: Qianhai Settlement Commercial Factoring (Shenzhen) Co., Ltd., based in Qianhai, Shenzhen, facing the whole country, providing all-round, professional and standardized supply chain financial services for the entire industry chain. Focusing on core enterprises that meet the basic requirements of supply chain finance, such as central enterprises, state-owned enterprises and large listed companies, it provides financial support and supporting services for the entire industry chain through reverse factoring financing, issuance of special asset-backed plans, etc.

As of February 28, 2019, it has successfully issued ABN (asset-backed notes) and ABS (asset-backed securities), and provided supporting financial products and services, with a total financing amount of more than RMB 14 billion. The total asset-backed issuance shelf quota approved by the China Securities Dealers Association and the exchange is RMB 43.64 billion. It has become one of the top supply chain financial service providers in China.

Business Model

Based on the commercial credit of core enterprises (account debtors), we provide factoring services integrating trade financing, account receivable sub-ledger management, accounts receivable management, and customer credit investigation and evaluation for clients (account creditors)。

Company advantages

Supply Chain Thinking

Maintain a healthy supply chain financial ecosystem to safeguard

Top IT Technology

Convenient for remote office work, low requirements for client software

Background Strength

Backed by powerful shareholders such as CGN

Integration of local and foreign currencies

Integrated system platform

Straight-through processing

Trading, monitoring, clearing, accounting

Comprehensive trading products

Bonds, lending, foreign exchange

前海结算保理年度大事件

01 ABN Dealers Association Approval---Shelf Issuance Quota of 21 Billion

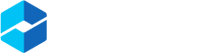

02 Qianhai Settlement 2017 First Phase Supply Chain Accounts Payable Asset-Backed Notes Successful

03 Qianhai Settlement 2018 First Phase Supply Chain Accounts Payable Asset-Backed Notes Successful

04 Qianhai Settlement Commercial Factoring Factoring Asset Cross-Border Transfer Project Successfully Implemented

05 Qianhai Settlement 2018 First Phase Minmetals Real Estate Supply Chain Accounts Payable Asset-Backed Notes Trust Successfully Issued

06 Qianhai Settlement Commercial Factoring (Shenzhen) Co., Ltd. 2018 First Phase Asset-Backed Notes Successfully Issued

07 Everbright Fixed Income-Southern Capital-Qianhai Settlement Supply Chain Finance No. 1 Asset-Backed Special Plan Successfully Issued

08 Zhongshan Ping An-Qianhai Settlement Supply Chain Finance No. 1 Asset-Backed Special Plan Successfully Issued

09 Qianhai Settlement 2018 Second Phase Minmetals Real Estate Supply Chain Accounts Payable Asset-Backed Notes Trust Successfully Issued

10 Qianhai Settlement 2019 First Phase Minmetals Real Estate Supply Chain Accounts Payable Asset-Backed Notes Trust Successfully Issued

ABN project ranking and scale

In 2018, Qianhai Clearing Factoring became the first domestic company to enter the ABN market. According to WIND data, it ranked first in total underwriting and issuance volume throughout the year!

Qianhai Clearing and Factoring relies on an advanced technology platform to complete everything from collecting compliant assets to disbursement through an online system. As of the first quarter of 2019, it has managed more than 1,000 suppliers, setting a benchmark for the industry system and laying a solid foundation for providing efficient supply chain financial services to small and medium-sized enterprises.

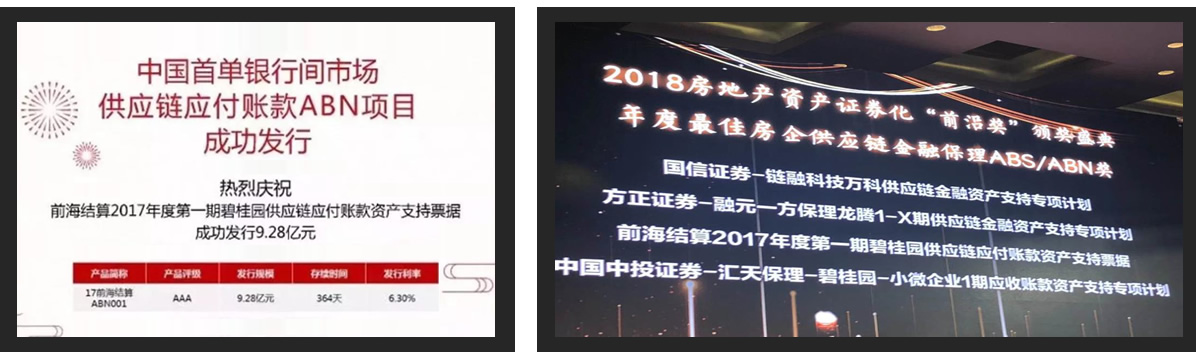

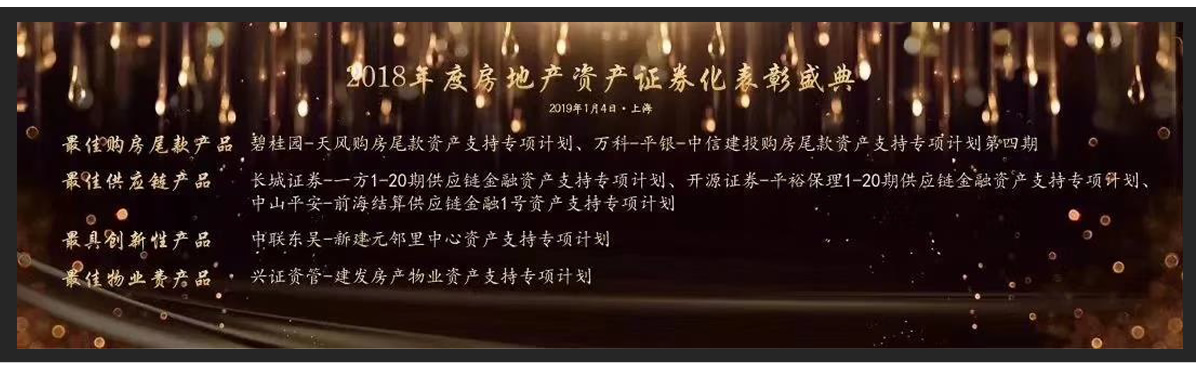

ABS/ABN Honors Awards

The first supply chain accounts payable ABN product frontier award in the interbank market The best real estate enterprise supply chain finance factoring ABS/ABN award in 2018

The first supply chain accounts payable ABN product in the interbank market

Overview of cooperation with asset securitization companies

Future Outlook

The core of supply chain finance is to provide efficient, professional, affordable and diversified financial services to small, medium and micro enterprises based on real transaction background. Qianhai Settlement Commercial Factoring has gathered an experienced professional team in the industry, combined with a strong technology platform, and has explored effective factoring product models in the practice of supply chain finance, and successfully issued a number of asset securitization products, becoming an important supplement to traditional finance and contributing to the "transformation from virtual to real" of China's financial industry.